- Who We Serve

- What We Do

- About Us

- Insights & Research

- Who We Serve

- What We Do

- About Us

- Insights & Research

Stewardship

Stewardship

At Northern Trust Asset Management, we believe that by serving as an active owner we help portfolio companies produce sustainable value over the long term. Our active ownership approach involves engaging in regular dialogue with portfolio companies to confirm that they are delivering positive long-term investment outcomes for the benefit of our clients.

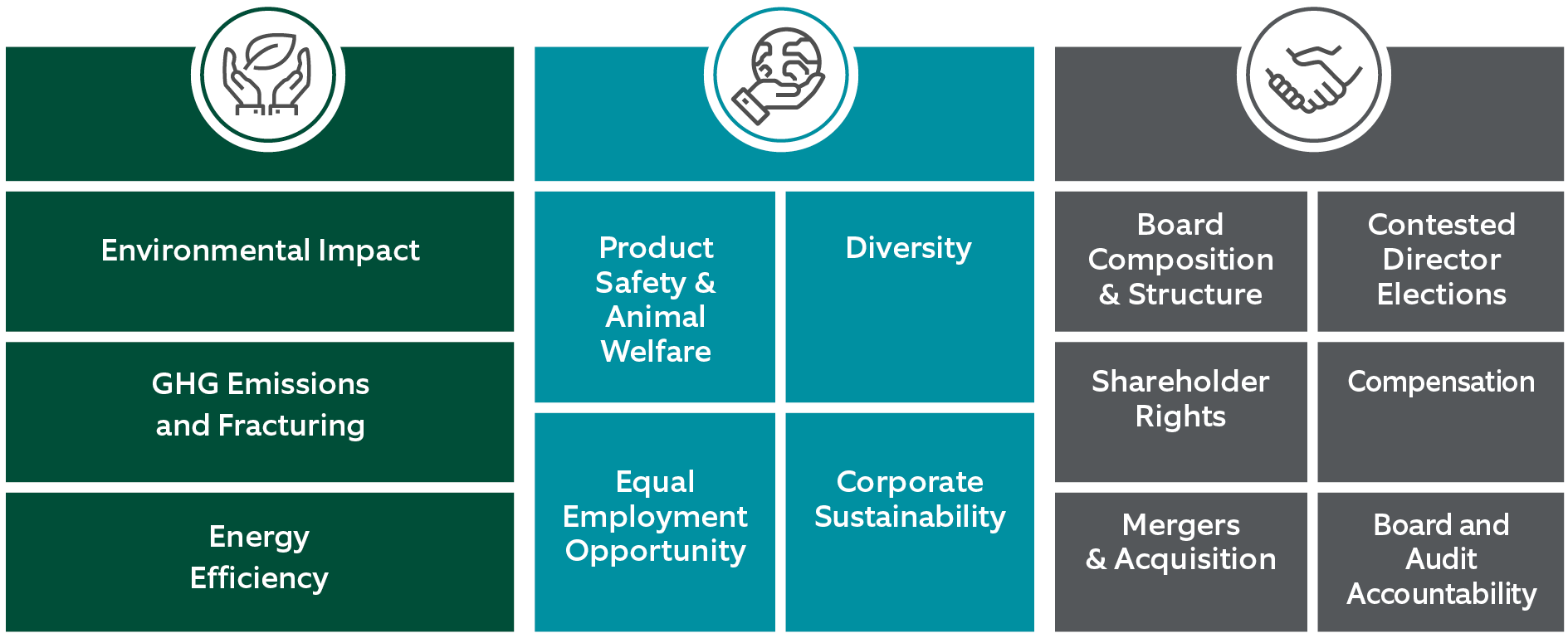

The fundamental precept followed by Northern Trust in voting proxies is to confirm that the manner in which shares are voted is in the best interest of clients/beneficiaries and will aim to maximize shareholder value. Northern Trust's proxy voting framework, as outlined in our proxy voting policies, procedures and guidelines, provide that the Northern Trust proxy committee will generally vote for or against various proxy proposals, usually based upon certain special criteria.

Stewardship Codes

The UK Stewardship Code

In July 2024, Northern Trust Asset Management (NTAM) was informed by the FRC that has maintained signatory status of the UK Stewardship Code 2020, a global best-practice in investment stewardship. This achievement demonstrates our deep commitment to the principles and purpose of the Code. The revised UK Stewardship Code 2020 comprises a set of 12 ‘apply and explain’ Principles for asset managers and asset owners designed to ensure the responsible allocation, management and oversight of capital to create long-term value for clients and beneficiaries. We applaud the FRC’s leadership in continuing to advance the disclosure and application of the standards and we continue to enhance our approach intending to remain aligned with the Code, client expectations and our commitments.

The New Zealand Stewardship Code

Northern Trust Asset Management has become founding signatory to the Aotearoa New Zealand Stewardship Code as of December 2022. This demonstrates our deep commitment to the principles and purpose of the Code.

The Code is based on an industry-led framework developed which aims to (1) create and preserve long-term value for current and future generations; (2) ensure the efficient management of capital whilst considering the best interests of clients and beneficiaries, and (3) contribute towards achieving sustainable outcomes for our environment, society, and economy.

Engagement Policies

NTAM Engagement Policy [PDF]

Since 2015 Northern Trust has incorporated an engagement program into our UCITS funds with Hermes EOS, providing an opportunity to engage with companies, to seek ways to improve their sustainability performance.

EMEA and APAC Pooled Funds Engagement Policy [PDF]

EMEA and APAC Pooled Funds Policy, List of Funds [PDF]

Stewardship Reports

Hermes EOS Engagement Reports

EOS Engagement List of NTAM Companies by Theme [PDF]

Hermes EOS Annual Engagement Review [Posted Soon]

Use the links below to view the full suite of Hermes EOS Quarterly and Annual Engagement Reports on all applicable Northern Trust Funds.

Quarterly

Proxy Voting

Our approach to voting proxies is to ensure that the manner in which shares are voted is in the best interests of clients and the value of the investment.

Visit our proxy voting page to review our proxy voting policy and how we have voted.

About Sustainable Investing

At Northern Trust Asset Management (“NTAM”), we define Sustainable Investing as encompassing all of NTAM’s investment strategies and accounts that utilize values based and norms based screens, best-in-class and ESG integration, or thematic investing that may focus on a specific ESG issue such as climate risk. NTAM’s Sustainable Investing includes portfolios designed by NTAM as well as those portfolios managed to client-defined methodologies or screens. As the data, analytical models and aforementioned portfolio construction tools available in the marketplace have evolved over time, so too has NTAM. NTAM’s Sustainable Investing encompasses strategies and client assets managed in accordance with client specified responsible investing terms (historically referred to as Socially Responsible), as well as portfolios that leverage contemporary approaches and datasets, including ESG analytics and ESG thematic investing.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Belvedere Advisors LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Our approach to voting proxies is to ensure that the manner in which shares are voted is in the best interests of clients and the value of the investment.

Visit our proxy voting page to review our proxy voting policy and how we have voted.

Important Information

Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For more information, read our legal and regulatory information about individual market offices.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Fund Managers (Ireland) Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc., 50 South Capital Advisors, LLC, Northern Trust Asset Management Australia Pty Ltd, and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Our approach to voting proxies is to ensure that the manner in which shares are voted is in the best interests of clients and the value of the investment.

Visit our proxy voting page to review our proxy voting policy and how we have voted.

This material is directed to professional clients only and is not intended for retail clients. For Asia-Pacific markets, it is directed to institutional investors, expert investors and professional investors only and should not be relied upon by retail investors.

Issued by Northern Trust Global Investments Limited.